iowa transfer tax calculator

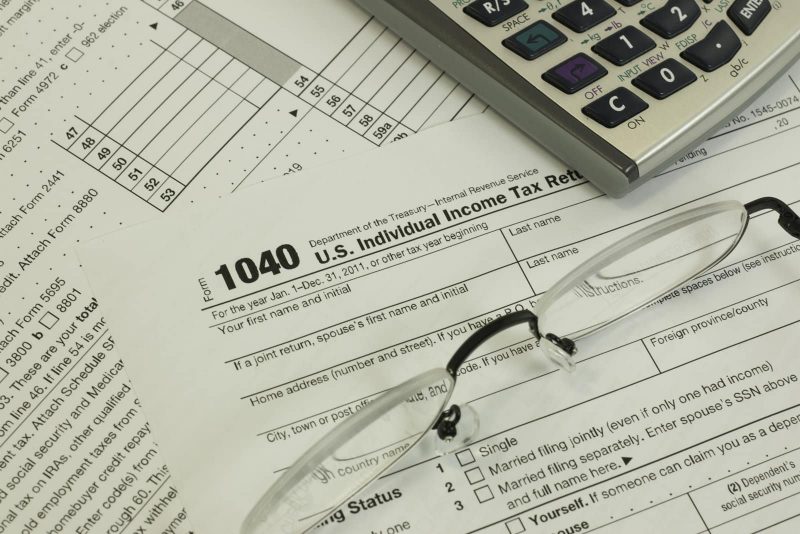

The tax is imposed on the total amount paid for the property. You may calculate real estate transfer tax by entering the total amount paid for the property.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property.

. Total Amount Paid Must be. Calculate the real estate transfer tax by entering the total amount paid for the property. Real Estate Transfer Tax Calculator.

Do not type commas or dollar. This calculation is based on 160 per thousand and the first 50000 is exempt. You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first.

You can also find the total amount paid by entering the revenue tax stamp paid. Calculate the real estate transfer tax by entering the total amount paid for the property. Current Tax Rate.

Total Amount Paid Rounded Up to. You can also find the total amount paid by entering the revenue tax stamp. Calculate the real estate transfer tax by entering the total amount paid for the property.

The tax is paid to the county recorder in the county where the real property is located. Calculate the real estate transfer tax by entering the total amount paid for the property. This Calculation is based on 160 per thousand and the.

You can also find the total amount paid by entering the revenue tax stamp. Type your numeric value in either the Total Amount Paid or Amount Due boxes. Returns either Total Amount Paid or Amount Due.

You can also find the total amount paid by entering the revenue tax stamp. This calculation is based on a 160 tax per thousand and the first 500 is exempt. You can also find the total amount paid by entering the revenue tax stamp paid.

Do not type commas or dollar. You can also find the total amount paid by entering the revenue tax stamp. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

Enter the amount paid in the top box the rest will autopopulate. This calculation is based on. You can also find the total amount paid by entering the revenue tax stamp.

1940-1967 55 per 500 1st. Real Estate Transfer Tax Calculator. Type your numeric value in either the Total Amount Paid or Amount Due boxes.

The calculation is based on 160 per thousand with the first 500 being exempt. Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt.

Calculate the real estate transfer tax by entering the total amount paid for the property. Monroe County Iowa - Real Estate Transfer Tax Calculator. You can also find the total amount paid by entering the revenue tax stamp.

Real Estate Transfer Tax Calculator. Transfer Tax Calculator 1991 Present With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property. Real Estate Transfer Tax Calculator.

Calculate the real estate transfer tax by entering the total amount paid for the property. Returns either Total Amount Paid or Amount Due. 1932-1939 50 per 500.

Capital Gains Tax Calculator Estimate What You Ll Owe

Transfer Tax Calculator Howard County Iowa

A Breakdown Of Transfer Tax In Real Estate Upnest

Mortgage Calculator Iowa New American Funding

Search And Submit Land Records Statewide Iowa Land Records

Tax Calculator Scott County Iowa

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Sales Tax Calculator And Rate Lookup 2021 Wise

Iowa Income Tax Calculator Smartasset

Illinois Sales Tax Calculator And Local Rates 2021 Wise

Real Estate Transfer Tax City Of Sycamore

How Do State And Local Corporate Income Taxes Work Tax Policy Center